The latest from Appital - Newsroom

Press Release

Appital expands European equity coverage

Press Release

Appital wins “Most Innovative Buy-Side Trading Workflow” at the A-Team Innovation Awards 2024

Press Release

Appital launches Insights to redefine how the buyside engage to unlock unique liquidity

Press Release

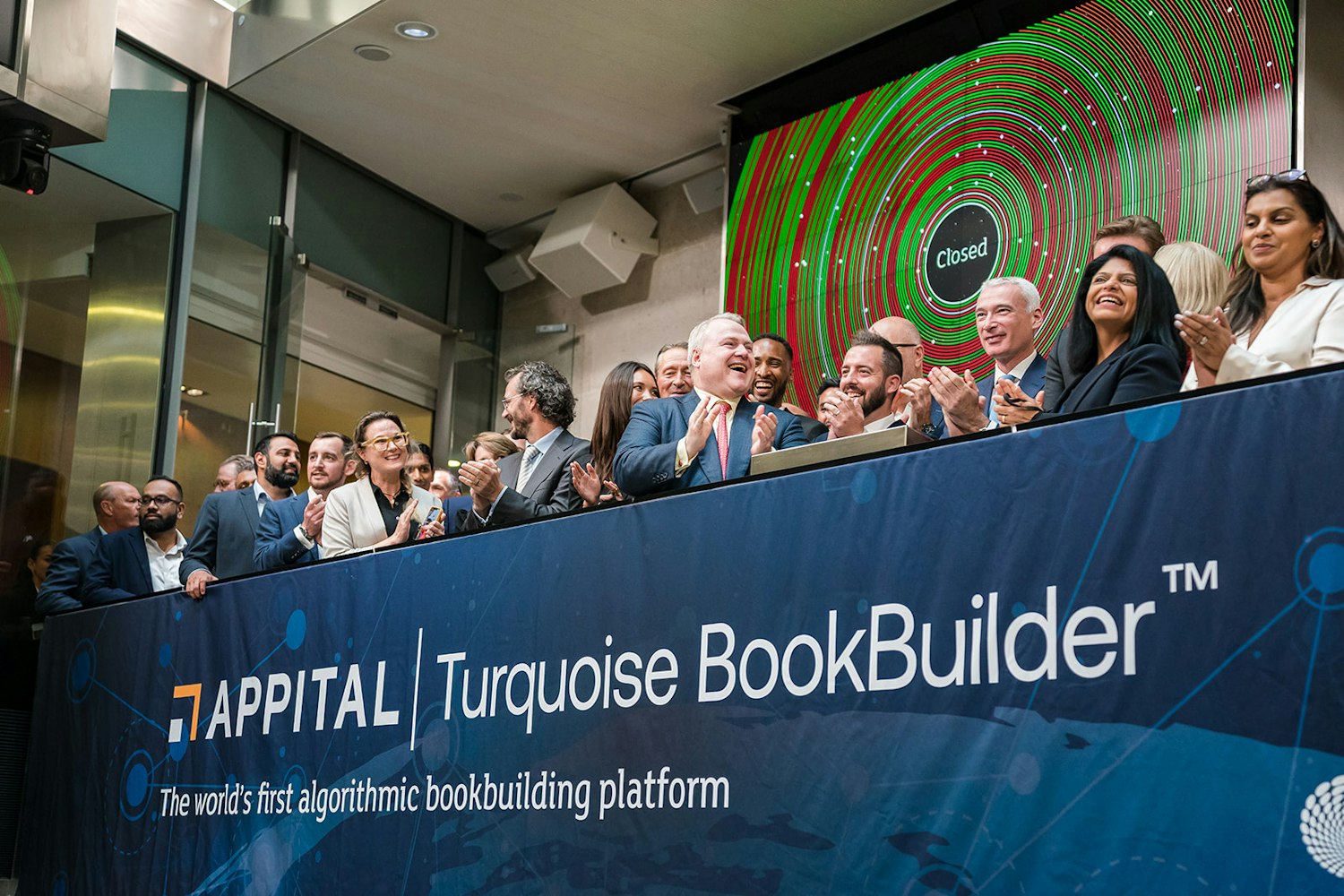

Appital Turquoise BookBuilder™ goes live with Norges Bank Investment Management completing the first trade

Press Release

FactSet’s Execution Management System Adds Integration with Appital’s Bookbuilding Platform

Press Release